Data sources: EPF's annual reports (KWSP), Ministry of Finance (MoF), Bank Negara Malaysia (BNM) and Auditor's General Report and Economic Planning Unit (EPU).

You may refer to my compiled sources here: Malaysian National Budget via Dropbox

No need to drill down the budget details - it's the same old thing. Only a few charts will do.

Spending more than we earn for a new record of 16 years in a row.

Hence we have been running fiscal deficits since the financial crisis of 1999.

Increased spending comes from ballooning operating expenditure. E.g. reckless handouts/promises of bonuses and etc. Development is sorely lagging behind.

Operating expenditure has now hit another new record high of 82% of our national budget allocation. Development expenditure is being squeezed hard. During Dr.M's time it was around 30s, PakLah's around 20s and now under Jib Goh it's 10s.

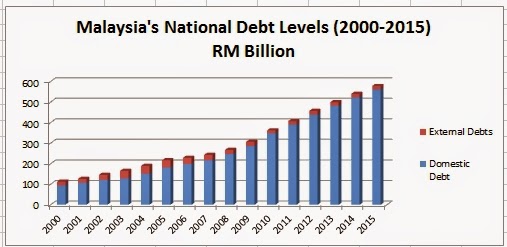

Persistent fiscal deficits are adding more and more to our total national debt further burdening future generations with ballooning national debt.

The country's national debt (domestic debt + foreign debt) is just short of its self-imposed ceiling of 55%. Very short = 0.02%.

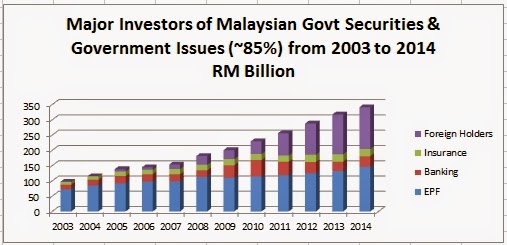

Nearly 30% of the national debt is held by the EPF and another 25% by foreign holders.

Contrary to the opposition party's opinion, I'm not worried about our debt to GDP ratio. This is because our debts are mainly domestic similar to Japan where its debt is 250% of GDP now although the high amount of foreign holders will leave our country's capital market more vulnerable to a sudden reversal of cross-border funds. However what is seriously more damaging is our persistently falling development/revenue ratio. Remember we are running deficits, if we minus out the deficit amount - almost every RM in the budget is used for operating expenditure only! Imagine this. You are earning RM 8,200. You have home utility bills of RM 8,200 and you got to pay them in full. You borrow RM 1,800 and that RM 1,800 is used to improve your livelihood. Seriously what a way to run the country. Bila nak bangun?