"The Petronas model is good. We want people to think of Felda as the next Petronas," says Tan Sri Mohd Isa Abdul Samad (CEO of Felda GV).

Back to the stone age, Malysia's economy after 'merdeka' was mainly tin and rubber in which these commodities account for 50% of GDP in the late 1950s. We received the 'wahyu' in the early 1960s, realising that we need to expand our narrow base of the economy and hence the debut of our "golden-crop" a.k.a palm oil. Thus came the establishment of FELDA (Federal Land Development Authority) in 1956, meant to promote rural development by opening new land for the benefit of the poor, mainly rural Malays.

FELDA has come a long way since its inception by our visionary TAR then but still a long shot from being what it should be. FELDA is the world's biggest palm oil player with close to 900k hectares in Malaysia and Indonesia. FELDA contributes 18% of Malaysia's palm oil output and 8% of the world's production in 2009. Yet their 2009 profit per hectare is nothing to be impressed compared to the likes of private entities such as IOI and Wilmar. Not forgetting Sime Darby which also sucks big time. GLC arr, SPV arr, whatever it is they are all the same = government. With high yield and low profit per hectare, there's only two possibilities for the low profit margin: CPO price is too low hence not profitable (obviously this isn't true) OR the cost in harvesting them is too high OR profits are being siphoned (this is more likely).

You could argue that FELDA has lots of CSRs such as housing schemes for settlers, Yayasan Felda, scholarships and Koperasi Permodalan Felda which erodes their profitability but I doubt their excuse as many of the second and third-generation Felda settlers feel displaced. Their chief complain lies in the lack of infrastructure and opportunities and they lean towards the opposition. This also does not explain why Sime Darby sucks that bad considering their CSR is not as widely scoped as FELDA. I also made a check with some local forums pertaining work in FELDA and here are some of the response:

1. Benefits = Very good, Experience = Very good, Life = Very boring

2. gov job, free time, tea time, anytime, good job, but don't hope too much on pay.

3. Full of corruption. Especially with the contractors/vendors.

4. benefit really good , got medical cover up to spouse and cover for maternity too up to 5 child (what! 5 children! you know what I mean)

5. Up to 5-6 months average bonus, 16% returns for Koperasi (KPF), subsidized loans, housing loans, medical benefits, 14% EPF contributions, etc.

The hallmarks of all GLCs: meritocracy and performance have been replaced by complacency and get rich quick mentality. This is state capitalism not a market based economy. The benefits in FELDA is just amazing but not surprising since it is also a political hot potato. FELDA has 113k settlers that has the voting power to decide on 54 parliamentary seats and 92 state seats and it is highly regarded as the ruling party's "fixed deposit" as long as the settlers are happy as demonstrated in Tenang. Happy via goodies such as strong benefits. No wonder Johor, Negeri Sembilan and Pahang are still their stronghold in which a large number of 400 FELDA settlements are located.

Since FELDA does not release their annual reports to the public though it is not required to do since it is not a public listed entity, I would assume it is an easy breeding ground for rampant corruption that takes place with contractors and vendors. You already know what happened to Sime Darby and its financial discrepancies. Why it is so difficult to publish such reports? National security? National threat? Mind our own business? God says so? With a new CEO at the helm of Felda Global Ventures: Tan Sri Mohd Isa Abdul Samad I reckon that things are still going to be roughly the same if not backwards. Look at his wiki and you will understand why. We need a politician that has been mired with controversy to run company, what the f....! Our brain drain is that bad?

Well, the new CEO has made clear of his intention to restructure FELDA through KPIs (again another jargon from our PM). 45 initiatives if successfully implemented will pave the way for value creation of RM1.15 billion (didn't say how much profit that will translate into but he wants a RM1 billion mark for revenue).

1. Increase the yield of fresh fruit bunch a.k.a FFB from 20 tonnes to 25 tonnes and oil extraction rate from 20.68% to 23%. Done via collecting loose bunches using buffaloes and replacing old palms.

2. Generating 30% of revenues from downstream which commands better margins such as oleochemical derivatives and speciality fats.

3. Monetise palm waste and by-products by tapping renewable energy. To spend RM7O million on converting its 70 mills into producers of green energy using palm waste.

4. Having a balanced age profile, with 5% immature palms, 5% old and the rest prime. Currently 47% of the palms are >18 years old, very skewed distribution.

5. Move towards a target of 40% local workforce by 2020, currently at an appalling 18%.

Nevertheless the KPIs remain as just KPIs with no comparison or any benchmark towards market performance or competitors. It needs to do better than that having been established for so long; 45 years or so.

If their published but unaudited reports are indeed true then FELDA is not "bankrupt" as what has been said by the opposition, bad move PR. Do you actually know the definition of bankrupt? In simpleton, liabilities > assets and cash flow unable to service debt levels. I do not think that the ruling party is that stupid to let their "fixed deposit" in the doldrums. But what is wrong is the gross margin of 6.8% and net margin of only 3.7%. Heck even the heavy tax GAB and CARLSBG has better margins than you. Are the profits siphoned by FELDA management and levels of middle mgmt and maybe for other political purposes like to "bina more rumah in Tenang"?

Despite its potential and fame as one of the world's most successful rural based land scheme development to eradicate poverty, FELDA remains as "F**king Elites Leeching Da Agency" instead of Federal Land Development Authority unless it change its old way. Proposed amendments:

1. Release of annual reports for audit: accountability and transparency.

2. List FELDA as a public listed entity and compete with other major oil palm players: domestically and internationally.

3. Businessman to run the business, politicians to run the country. Get that goon out!

4. Incentive to managers based on performance (e.g. higher bonuses for better profit per hectare)

5. Contracts and vendors must be awarded through open tender not closed door negotiations.

6. FELDA's improvements and projects to be announced in the open for public opinion and feedback.

7. Actually the list goes on and on.....since there is so much to fix

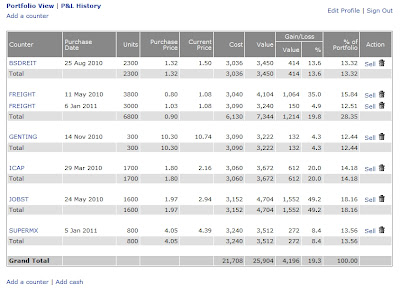

In a nutshell, and I have said this many many times. Avoid GLCs in Malaysia (here's the list of them) if you are looking to invest in the long run. My fundamental strategy of compounding my hundred thousand into millions in 30 years does not need any help from the complacent GLCs. Unless they change 360, nothing with interest me towards them. FELDA you got to do better than what you plan to do, "tak cukup bagus, faham tak?"

P.S. I have high respects for PETRONAS. Many times they held their own ground only to be pressured by our greedy government. I love you Hassan Merican and damn the men in office for replacing you!