Oil price (most specifically Brent Crude) is $48 as of this writing. Oil lost 50% of its value in just 6 months and is expected to be low if not lower for a considerable amount of time. The falling oil price has nothing to do with Malaysia, in fact we are too small to make any difference, 'kita tonton saja'.

We are enjoying cheaper fuel at the pumps but let's not be so happy since our country is running on auto-pilot. There is a price war between the Shale (US) and Sheikh (Saudi Arabia). America oil producers are pumping oil like rain falling from the sky. Meanwhile the desert kingdom has shown no willingness to reduce production so they could maintain market share and even issued a challenge:

Saudi Arabia Ready For $20, $30, $40 Oil

What do we have to say?

Drop in oil prices should not have adverse effect on country's deficit, says Tee Yong

KUALA LUMPUR: The drop in world oil prices should not have an adverse effect on our country's deficit as the average price from January to November has met the expectations set. You living in the past? The budget is based on forward looking estimates so I want to know 2015 not 2014.

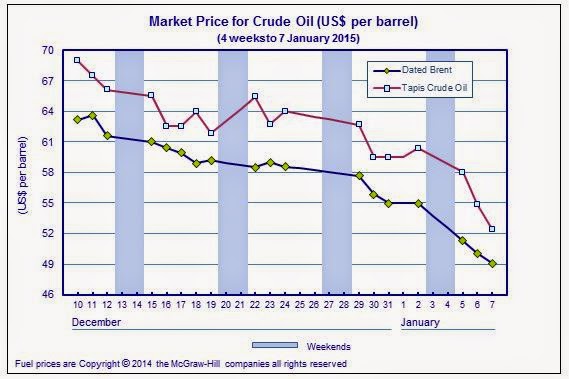

Deputy Finance Minister Datuk Chua Tee Yong said that speculators should not be confused as Malaysia relies on the Tapis Crude and not Brent Crude. Both oil index correlates very well, I just took a weekly snapshot below but I've checked the entire 2014 so he is taking us round the moon.

"The average price for Tapis Crude has been above USD100 (RM344) per barrel between June to November and this meets our expectations," he said Wednesday. The average is $95 and this is not exactly above. Another horse crap from our deputy.

Budget 2015, 'An Zhua'?

Malaysia needs to revise Budget 2015, says Credit Suisse

Revenue projected RM235.2 billion.

Spending estimated RM273.9 billion.

This means we are short of RM38.7 billion, also known as fiscal deficit. This is -3.67% of GDP projected for 2015.

Oil and gas-related income is a backbone of the Malaysian economy as it currently accounts for 30% of the government’s total revenue. Let's assume this is correct (because credit agencies, banks and economists are quoting this figure, 'takkan semua salahkan', these are professionals not like our cabinet.

Revenue derived from oil & gas (O&G) RM235.2 billion x 30% = RM70.56 billion.

Because our budget is based on $100 oil price (said by PM Najib and endorsed by MoF, bukan saya kata), this means our revenue derived from O&G related income is halved. RM35 billion short now!

So it becomes like this:

Revenue: RM200 billion.

Spending: RM274 billion.

Guess the deficit? Close to 7%. 'Wa kasi' discount: 6%, still 100% short of our 3% target. We should and must meet the target, otherwise our country's credit rating could be downgraded, we wouldn't want that - later 'macam' Greece. We have to cut spending somewhere OR raise revenue somewhere.

How to 'potong'? Operating expenditure is already RM223.4 billion which includes fixed charges and grants, emolument (civil servants), supplies & services. We can't cut this unless we trim the civil service which is highly unlikely.

We have the remaining RM50 billion for development. We can reduce security (no need to buy tanks and planes, we are not going to war) but that's not enough. We could cut economic sector developments such as smaller not so urgent federal projects. Some might get the knife but that's still not enough. Remember we need RM35 billion and that's assuming the oil does not fall even more; <$50.

The only option left is to raise revenue. [1] more direct and indirect taxes [2] ask more from Petronas. The former is happening now. Suddenly a slew of goods and services are GST-able; from insurance premiums to PG Bridge toll and Johor causeway to medical supplies and healthcare services. The latter is not likely as Petronas is being hit like a brick by falling oil price; it has to cut capex (capital expenditure) and just recently opex (operating expenditure). After slashing capex, Petronas plans up to 30% cut in opex

With the destruction of our East Coast due to flooding, more funds are needed for repairs. Furthermore we have this 1MDB RM2 billion default loan payment, govt is in no position to bail. Someone has to foot the bill... someone.

No comments:

Post a Comment