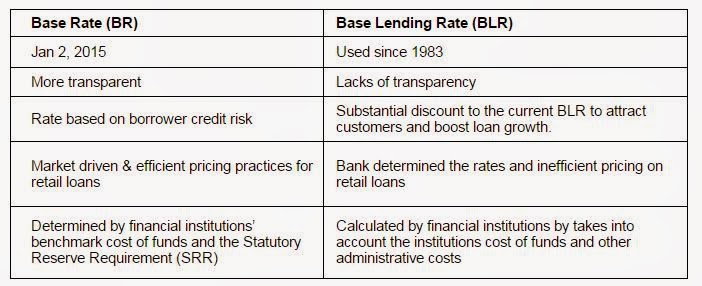

As many of you know the new Base Rate (BR) mechanism is effective starting 2nd Jan 2015 which is to replace what we refer to as Base Lending Rate or BLR. New Reference Rate Framework by Bank Negara Malaysia (BNM). Both of these are set by the each bank individually, this is why the rates vary from bank to bank. However there they are very dependent on something called the Overnight Policy Rate (OPR) for the BLR and Statutory Reserve Requirement (SRR) for BR which BNM determines.

BNM meets every two months which fixed schedule in a meeting known as MPC (Monetary Policy Committee). This is where they debate and decide if the OPR and SRR should be adjusted higher or lower. The decision to do so takes in account various economic indicating factors (in no order), such as inflation, economic growth, strength of currency and etc. Basically the overall economic outlook. BNM adjusts the rate according to how much money they want in circulation versus how much should be tied up in savings.

|

| MPC Meeting Schedule in BNM Website |

The good thing is that the Base Rate must be reviewed by banks at least on a quarterly basis & the same to be disclosed publicly.

|

| Base Rate and Effective Lending Rates of Banks 2nd Jan 2015 |

For illustration purpose:

Loan Amount: RM350,000 (No Lock-In Period)Loan Tenure: 30 years

Before 2 Jan 2015

|

From 2 Jan 2015

| |

|---|---|---|

| Reference Rate | BLR = 6.85% | BR = 3.67% |

| Interest Rate | BLR - 2.20% | BR + 1.00% |

| Effective Lending Rate | 4.65% | 4.67% |

| Monthly installment (RM) | 1,804.73 | 1,808.93 |

You will immediately notice that the monthly installment difference is negligible. But of course the above is just an illustration. If you don't believe compare your Dec 2014 housing loan statement vs Jan 2015 housing loan statement. The reason why it differs slightly is because the BLR is dependent on OPR (3.50%) while Base Rate is dependent on SRR (4.00%). The spread is very narrow and therefore the effective lending rate is almost the same (plus minus here a bit la...maybe enough for a plate of Chicken Rice).

The Base Rate will be used for the new retail floating loans and refinancing of existing loans extended from 2nd Jan 2015. After the effective date, BLR based loans prior to 2015 will continue to be referenced against the BLR. Also, when any bank makes an adjustment to the Base Rate, a corresponding adjustment to the BLR will also be made. Currently, the BLR is 6.85% while the prevailing mortgage rates hover between 4.20% to 4.90%.

Why use SRR now?

It is a BNM tool for the purpose of liquidity management. Effectively, banking institutions namely commercial banks, merchant/investment banks and Islamic banks are required to maintain balances in their Statutory Reserve Accounts (SRA) equivalent to a certain proportion of their eligible liabilities (EL), this proportion being the SRR rate.

As explained above, higher SRR means that banks in Malaysia will have to keep more money as their reserve. This translates into lower loans growth for banks. Normally, banks would impose stricter loan approvals for borrowers, because less funds are available for lending. Normally, very high SRR translates into lower profit growth for banks, lackluster borrowing and lower economic growth (who doesn't like to leverage?)

Since SRR is available to BNM to manage liquidity and hence credit creation in the banking system, it will be used to withdraw or inject liquidity when the excess or lack of liquidity in the banking system is perceived to be large and long-term in nature. Currently, BNM believes that our banking system is OKAY in liquidity, thus it maintained the SRR since 2011 to "buffer" some money in banks.

"KUALA LUMPUR: Bank Negara Malaysia (BNM) Governor Tan Sri Dr Zeti Akhtar Aziz said the Statutory Reserve Requirement (SRR) will only be adjusted if there is a fundamental change in liquidity in the financial system.

"SRR will only change if there are fundamental shifts that result in fundamental changes in liquidity condition. If it is temporary, then it will rely on open market operations,""

Conclusion

It looks like it is LPPL. However this is because the spread between OPR and BLR is very narrow. It is not as straight forward as it seems. If BNM raises OPR and thus BLR but maintains SRR, consumers will mostly likely refinance. There is a lot of juggling going around.

With the fall in oil prices now at $50, down $5 in a single weekend coupled with further weakening of the MYR at 3.55 to USD, impeding 6% GST, things don't look well for us. It remains to be seen what BNM will do when it meets again on 28th Jan 2015. We as consumers will still need to pay attention to OPR and in addition the SRR now.

No comments:

Post a Comment