|

| 2 Permai, Tanjung Bungah, Penang by BSG Property |

Introduction

F&N is mainly involved in the manufacturing of soft drinks (carbonated), dairy products and glass bottles and containers. It is the second largest F&B (food and beverage) company in Malaysia losing no.1 spot to Nestle Malaysia Bhd. The group has decided to exit from the glass business to unlock the value of its investment in Malaya Glass Products and fully focus on being a regional F&B enterprise. F&N completed the sale of MGP in July'2010 for RM710 million cash.

The group has also just sealed an agreement for the sales and distribution of Red Bull energy drink (all 3 Red Bull products) in Malaysia in April'2010. Red Bull has a very good presence within Malaysia as it is the leading energy drink with a 40% market share. With that, revenue loss from MGP disposal ~8% is being offset by the gains from Red Bull ~10% of revenue to F&N.

The group has also just sealed an agreement for the sales and distribution of Red Bull energy drink (all 3 Red Bull products) in Malaysia in April'2010. Red Bull has a very good presence within Malaysia as it is the leading energy drink with a 40% market share. With that, revenue loss from MGP disposal ~8% is being offset by the gains from Red Bull ~10% of revenue to F&N.

Not known to many, F&N also has a property division which has its focus on the development of Fraser Business Park with a gross development value (GDV) of RM350 million. Phase one has 80 shop/office units all sold out. Phase two is an ICT hub with HELP university college with hostel complex, services apartments, e-Hotel, retail entertainment space, hypermarket, food court and outlets with 1,800 parking lots. F&N has a signed lease agreement with HELP for a 15-year period.

Still ~98% of F&N's revenue comes from its core F&B line. With about RM1 billion in cash, F&N purchased a 23.08% stake in Cocoaland Holdings Bhd for only RM54.6 million in Aug'2010. With that F&N has just entered the snack food market in Malaysia. Cocoaland is the sole manufacturer of coco pie in Malaysia and a leading manufacturer for gummies in ASEAN region & also exports. This is in line with F&N's strategy and the synergistic deal is a win-win for both parties.

Fundamental

1. Does the company have an identifiable durable competitive advantage?

Being Malaysia's largest soft drink company it has a very established portfolio. 100PLUS, F&N Fun Flavours (like Sarsi & Orange that we always see at Chinese weddings), SEASONS and Fruit Tree & Soft drinks: http://www.fn.com.my/food.aspx

Dairies: http://www.fn.com.my/Dairies.aspx

2. Do you understand how the product/service works?

It's a consumer product no need for further explanation.

3. What is the chance that it will become obsolete (KO) in the next twenty years?

With brands that will continue to provide stellar performance for the company, answer is NO.

4. Does the company allocate capital exclusively in the realm of its expertise?

Yes & No. It previously has the glass division and now still with a property division. Though F&N is good at unlocking the values for both, in the end they realised it is best to focus on what they do best which is F&B and recent activities shows they are doing it.

5. What is the company's financial history and status?

|

| Financial Chart 1 (updated) |

- Net Profit Margin: 6.22% vs 5.80% (Industry), 6.07% (Sector)

- Gross Profit Margin: 27.50% vs 48.92% (Industry), 36.76% (Sector)

- ROE: 14.34% vs 12.27% (Industry), 14.33% (Sector)

- Revenue Growth Rate: 16.68% vs 6.32%, 9.99% (compounded annual growth rate)

Gross margin is far from average. Cost of goods sold is high. Revenue GR of 16.68% is due to the 200% revenue increase of the group's liquid milk business it acquired from Nestle. I computed that the annualised average over 10 years is 7% which is more appropriate. Also this % is in line with the revenue growth rate of the industry and sector.

|

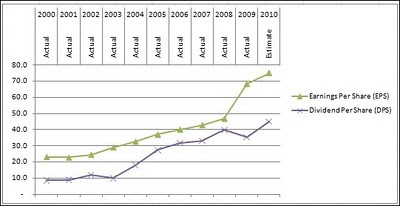

| Financial Chart 2 |

Very nice chart showing consistent growth on both EPS and DPS. F&N has maintained a good ~70% dividend payout ratio to its earnings per share since 2005 and ~50% for the years before it.

6. Is the company conservatively financed?

With RM1 billion cash in hand, liquidity is not an issue but F&N has debts of about RM563 million which amounts to a DE ratio of 0.4 as of financial year 2009. Well it still below my threshold limit of 0.5. The bulk of the borrowings came during 2007 of RM330 million and subsequently another RM90 mil in 2008 and RM200 mil in 2009. All of these were needed for the liquid milk business it obtained from Nestle in the year 2007 & also for the two new plants in Pulau Indah, Malaysia and Rojana, Thailand.

Inventory turnover at 2.5 months is at a healthy level over the last 5 years, this simply implies that F&N is able to sell its good every 2.5 months and replace inventory with new goods. Receivable turnover is at 3.5 months on average of the last 5 years. This figure is okay too.

7. Is the company actively buying back its shares?

Over 2008 and 2009 there were five buybacks of 12,500 shares which is not a lot. But F&N has treasury shares of 237,100 for use but not likely to be utilised given their abundant cash.

8. Is the company free to raise prices with inflation?

Yes and the group always has a habit of openly announcing price hike before it takes effect. Sugar is an important element for the manufacturing of dairies and soft drinks for F&N.

9. Are large capital expenditures required to update plant and equipment?

Oh yes. Started in Oct'2009 the RM350 million canned milk plant in Pulau Indah will be the largest in Southeast Asia when it is completed in early 2012. F&N also opened its dairy plant at Rojana, Thailand in Sept'2009 tagged at RM250 million price tag.

Discounted Cash Flow Analysis

Instead of using the 16.88% revenue growth rate, I will use my own computed annualised rate of 7%. To be really save I can also opt for 5% which was the rate before F&N acquired the liquid milk business from Nestle in 2007.

Operating Costs: 91% of revenue (distribution & marketing expense ~17%)

Corporate Tax: 25%

Capital Expenditures: RM150 million +7.5% each year (not factoring cost of new plants as 1 time only)

Depreciation: RM120 million +7.5% each year

Working Capital Cost: +5% each year in line with revenue growth rate

Discounted Rate: 10%

Fraser & Neave Holdings Bhd is fairly valued at RM11.18. The current trading price of RM14.28 is expensive and at a premium for purchase. The P/E ratio of F&N is at 22.78 with Industry at 26.95 while sector at 15.24. In my opinion overvalued at time of writing.

If I were to put 7% revenue rate and working capital growth it is only fairly valued at RM11.93. To be frank the figures I put in my valuations for DCF are very conservatives so put some flexibility in there and I will still not overpay >RM12.50 for F&N.

Looking at the chart below, I am able to see a sharp spike followed by minor correction very recently. If I apply VSA (volume spread analysis) it is smart money toying with greedy investors as a higher high price together with lower low volume shows absence of momentum and pressure to sell which resulted in minor correction. Best not to jump into F&N now.

|

| The very resilient share performance of F&N over the last 10 years |

Conclusion

- The Coca-Cola Company (TCCC) which is setting up a bottling plant in Negeri Sembilan to be ready by end of 2011 when F&N loses its right to sell Coca Cola products in Sept'2011. TCCC has no track record in Malaysia so it remains to be seen how well they can perform.

- CI Holdings which has exclusive rights to bottle and distribute Pepsi and 7UP in Malaysia. CI launched Tropicana Twister an orange juice product which proved to be very successful. CI Holdings' financial record hasn't be nice either until Tropicana product made the figures better since 2008.

- Yeo Hiap Seng with Brands like Yeo & Justea and is market leader in soya bean and tea (herbal and chrysanthemum) drinks. YHS is in the blues with continuous falling share price after losing rights to sell Red Bull to F&N and lower sales in Indon due to cancellation of 15/31 of Yeo's product pending new registration.

To counter the loss of Coca Cola, F&N has earmarked up to 50 drink variations to be launched in 2010-2011. F&N also has plans to expand market reach of its drinks as exports particularly Indonesia which is evident on its new plant in Pulau Indah to support that. F&N lost Coca Cola rights because they were unhappy that F&N did not improve the sales as much as it did on other line of products. According to CEO Ng Jui Sia, Asians have preference of fruits juices over carbonated soft drinks. TCCC was established because it thinks it can do better than F&N.

Now we take a look at dairy segment which contributes more revenue than soft drinks to F&N.

- Dutch Lady Milk a solid company which I wrote before. F&N Carnation has the largest market share 60% in condensed milk but the liquid milk business belongs to DLady. Financial record is good for DLady so F&N will need to maintain its lead on condensed milk.

- Malaysia Milk Sdn Bhd but is not listed. Sellers of Vitagen, Marigold products including the Peel Fresh line, mlik, yogurts, jelly and condensed milk. Vitagen is quite untouchable and Peel Fresh providing a lot of rivalry to F&N's juice products.

- Nestle Malaysia the biggest F&B player by market capitalisation. It is generally dominant in powdered milk products and fortified drinks such as Milo, Nestum etc. Nestle does many things with a portfolio of over 300 products under several brand names. Though size matters it does not rule the liquid milk business nor fruit juices nor soft drinks.

|

| F&N the Lion King? |

With still a lot of cash in hand, F&N is still looking for more M&A (merger & acquisitions) opportunities. Cocoaland is just the beginning and it was a good deal buying at a discount and a win-win for both parties. Market is tough and intense as seen in the net profit margins of less than <10% across most F&B companies. With focus fully shifted on soft drinks and dairy products, F&N is on the right track at least.

I am not so worried about the debts being used as leverage because it is needed and has the financial power to pay it off in less than 3 years. F&N has been managed very well for many years and is expected to continue to do so. With good ROE figures, consistent capital appreciation & decent dividend payouts, F&N is a buy for me on this good blue chip stock. F&N do exports to more than 20 countries and that fits my criteria.

Buying into F&N at the right time might be difficult as the major shareholders consist of parent company Fraser and Neave Ltd at 57.33% and Permodalan Nasional Bhd at 24.24% thus leaving little room for free float. Swapping DLady for F&N is a viable choice as DLady does not export. Will wait and see if any news could rock the share price down a little or at least put it at a fairly valued price. Btw this is my Raya goodie though one day late haha. Happy Aidilfitri to all my readers :)

No comments:

Post a Comment