|

| Bugis Bucaneer. As of July 7th: 1 US Dollar equals 3.83 Malaysian Ringgit |

Highlights

- Portfolio's increased in value even when global markets are volatile (Greece's default and possible exit from Eurozone) and in the wake of more Malaysian financial worries (1MDB, "lanun" Bugis, MYR continued weakness)

- Maintain all ratings, similar as June'2015. Aboi's Portfolio Review For June 2015.

- No new additions in June. Likely to have one in July :)

- Beginning next month I will also talk about my US holdings (sold all back in May 2015 except for Costco) and figure out how to integrate it within here.

|

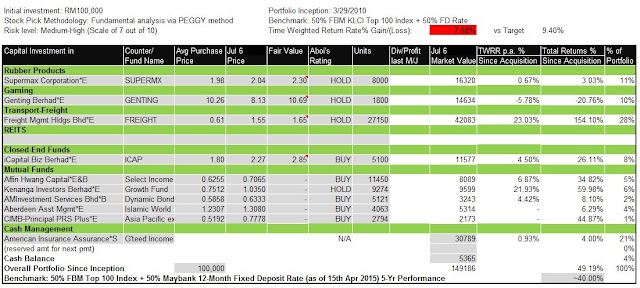

Portfolio target composition. Equities 65%, Bonds 25% and Supplementary 10%.

Targets for returns p.a. Equities 12%, Bonds 5% and Supplementary 3.5%.

|

Notes

- Nil

- Portfolio target for the 5th year @ RM156k for April 2015: Slightly OFF.

- Portfolio target for the 6th year @ RM171k for April 2016.

- The TWRR (time weighted annual return rate = 7.88%

- TWRR up by 0.18% from June'15 vs portfolio target = 9.40%).

Supermax (Equity Malaysia)

- Maintain HOLD. Uncertainty in local stock market.

- Maintain fair value (RM2.30). No new developments. See below for previous month June'2015 update.

- Stock crippled due to fire at its Alor Gajah plant but has since recovered.

- Growth in capacity from two new plants in Meru, Klang which will double nitrile gloves production from 6.9b to 12.3b pieces p.a.

- Still has attractive valuations vs peers e.g. PER & Div Yield.

Genting (Equity Malaysia)

- Maintain HOLD. Uncertainty in local stock market.- Maintain fair value (RM10.69). No new developments. Stock took more beating and is further undervalued, no reason to sell as fundamentals have not changed. See below for previous month June'2015 update.

- However most of its current investments will only come to fruition in 2H15/2016 so there is no short term catalyst to prop up share price.

Freight (Equity Malaysia)

- Maintain HOLD. Uncertainty in local stock market.

- Maintain fair value (RM1.65). No new developments. See below for previous month June'2015 update.

- Stock took a beating due to cessation of a 3PL contract and temporary closure of a warehouse for renovation but expected to slowly recover.

- Growth will be supported by its core Sea Freight division and trade within Asia-Australia region.

ICapital (Closed-End Fund Equity Malaysia)

- Maintain BUY.

- Huge discount from current price to NAV (20.35%)

ICapital (Closed-End Fund Equity Malaysia)

- Maintain BUY.

- Huge discount from current price to NAV (20.35%)

Affin Hwang Select Income Fund (Equity & Bond - Asia)

- Maintain BUY.- Asia Pacific's healthy credit market more or less can offset stronger USD in the coming months. See below for previous month June'2015 update.

-Strong USD will make headwinds for Asia markets as such fund pare down exposure in equities (30% -> 20%).

- Also doubled cash levels to 7% and continue exposure on Asian credit market pending US Fed's direction in the 2H15.

Kenanga Growth Fund (Equity Malaysia)

- Maintain HOLD. Uncertainty in local stock market.- Because fund held so much cash, impact from recent KLCI activity is very minimal. See below for previous month June'2015 update.

- Lack of catalyst in the short term, fund holding high level of cash ~20-25%.

| FUND PERFORMANCE (BID TO BID CUMULATIVE RETURNS) | |||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||

- Maintain BUY.

- No change in my commentary but have to be aware of BNM 4th MPC meeting in 2 days. See below for previous month June'2015 update.

- BNM will likely continue its policy pause and maintain cautious stance with a "wait-and-see" approach on US Fed direction.

| FUND PERFORMANCE (BID TO BID CUMULATIVE RETURNS) | |||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||

Aberdeen Islamic World Equity Fund (Equity Global)

- Maintain BUY.- Thanks to Greece, fund retreated slightly due to its medium exposure in Europe. However I see opportunity in current selloff, Greece not likely to have a big impact in Europe's financial woes as it once did in 2012. See below for previous month June'2015 update.

- Fund has no exposure to China's overheated stock market and slowing economy. Fund also has 18% exposure to the already lofty valuations in US equities so impact is minimized if a correction occurs.

- Fund continues to be very diversified globally; Healthcare (21%), Materials (16%), Energy (15%), Industrial (13%), Consumer Staples (13%).

| FUND PERFORMANCE (BID TO BID CUMULATIVE RETURNS) | |||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||

CIMB Principal PRS Asia Pacific Ex Japan Equity Fund (Equity Asia)

- Shanghai's stock market corrected by as much as 16% to date but fund's exposure is minimal so I'm safe. Fund's recent weakness is mainly attributed to Greece event causing some selloff in almost all major markets worldwide including Asia Pacific. See below for previous month June'2015 update.

- Fund holding exposure to China's overheated stock market is minimal ~10%.

- Positive on Asian Equities but growth will be more scarce moving forward as regional portfolios are fully invested hence earnings will depend highly on stock selection.

| |||||||||||||||||||||||||||||||||||||||||

Disclaimer: The reports, analysis and recommendations in this blog are solely my personal views. I do not link to any investment body or company. As such, I will not be responsible of any of your investment decision. Consult your investment adviser or come to your own conclusions before making any investment decision.

No comments:

Post a Comment