Precious Metal: Gold

Rating: UNDERPERFORM (KEEP IN VIEW)

Current Price: $1,179 (from $1,334)

Target price: $1,100 to $1,150 (unchanged)

Fundamentals: Long Term Outperform (5-year period)

Sentiment: Medium Term Bearish (6-month period)

Risk Level: High

**Outperform: Expected to do better than market return; has upside or cheap vs target price. Usually a buy call.

**Market perform: Expected to be on neutral, can be + - 3% to 5% either way; Usually a hold call.

**Underperform: Expected to do worse than market return; has downside or too expensive to buy vs target price. If fundamentals change a sell call.

I have talked about gold a couple of times.

First was back in late 2012 -> http://aboiwealthpot.blogspot.com/2012/10/the-yellow-fever.html. This was when gold was at it's all time high of $1800 and I have warned the perils of holding gold.

"To the disbelieve of ordinary folks, gold is just like any commodity. IT DOES NOT GO UP ALL THE TIME."

"If you have gold now, it's time to review your holdings. If you are thinking about getting into gold, think twice and HARD. A few useful indicators to look out for.

No 1. If the central banks of major economies start raising interest rates, it is tough for all investment classes which includes gold. Because there is little point in putting cash into the banks when interest rates are low, people will buy gold as a hedge against inflation.

No 2. If the US dollar has strengthened, decrease in gold prices will follow. This is because people use gold as a substitute/hedge for the world's reserve currency."

No 2 is happening now. No 1 at the current trend would only apply to the US economy where it is foreseeable that the Fed will raise interest rate as early as 2015.

Next I posted in late 2013 -> http://aboiwealthpot.blogspot.com/2013/12/a-fool-and-his-gold-are-soon-parted.html. This was when gold of $1250 was experiencing a sharp decline.

" increasing demand does NOT come from jewelry or technology (I consider this a stable form of demand) it is from financial investments (speculative/hedging form of demand)."

"Equities or stocks are by far the best indicator to look at. It does not correlate with gold prices. E.g. if US stocks fly high, gold prices would be the opposite OR if interest rates goes up, folks would rather invest in cash rather than gold."

The US stock market is at it's all time high now, higher than pre-crisis levels of the 2008/2009 financial crisis.

Lastly I posted in early 2014 -> http://aboiwealthpot.blogspot.com/2014/03/speaking-of-recent-gold-demand-trends.html. When gold of $1350 made a small comeback.

"The only major factor keeping gold supported now is the RETAIL INVESTOR, people like me and you but actually not really us la. Whose buying them? The Chinese and Indians especially!"

"Back by India's restriction to limit gold import in mid 2014 and China's appalling just released PMI index, gold is going to meet resistance in the $13xx range."

It is did meet substantial resistance and is now hovering below $1200.

Let's examine what is happening now @ <$1200:

[1] I put the normal retail investor as either buying jewellery or investment such as physical bar demand. Both are running out of fuel. Though there is no Q3'14 data yet, judging by the current price it is safe to assume the trend is resuming.

[2] India's new PM Modi wants the Indian people to use banking instruments and hold less gold and is making it one of his to-do list and with the restriction to limit gold import (that will last to 2015) is hurting retail demand in India.

[3] China's demand is waning as well. Could it be President Xi Jinping's massive anti corruption drive (which will continue for years to come) hurting demand for luxury good such as gold?

[4] Strong US dollar and with the US Fed finally ending its QE3 program, it signals that it is almost time that they will start raising interest rates which will further boost demand for the greenback that will hurt gold. This is because holding the shining metal has no yield (it does not pay any interest).

[5] Also BoJ's (Bank of Japan) just announced an aggressive QE program of it's own. This will boost the stock market of Japan, fueling the flow of money into equities. The ECB (European Central Bank) might be mulling the same idea considering that Europe (except UK) is re-entering recession. Money has to flow from somewhere and it will come from commodities like gold. Again because holding commodities has no yield.

[6] Russia might be selling some gold reserves to meet financial demands due to suppressing oil prices (which contribute a lot to the state budget) & also sanctions from Western countries.

How to get gold's fair value?

The answer is I don't know. It is not like an equity where various financial ratios can be used for in modelling e.g. PEGGY or DCF. What I do is simply identifying trends on the macroeconomics level - understanding what is happening around the globe e.g. be it financial or political. This is pretty much similar to how I did for palm oil where I was invested in BSDREIT and gained a nice 65% profit for holding it for 3 years.

Back to gold, my target price ($1100 to $1150) and support line ($1000) remains unchanged. Pre-crisis financial crisis 2008/2009 prices were slightly below $1000 and at $800 as seen in 2007 when central banks were selling gold but now they are buying . Furthermore 100 tonnes each quarter for 14 consecutive quarters since 2011. In the long-term Jewelry demand should recover (with Asia's rapidly rising middle class), Technology demand to remain flattish, Total bar and coin demand as a form of investment will continue to slug as long as the markets around the world remains healthy. A majority of central banks should continue to hold and increase gold reserves as global monetary backup because the world economy remains unpredictable if not messier.

Thus I am assuming that demand will normalize to 2008 levels ~3800 tonnes per year. At the height of the gold price it was 4700 tonnes. Now it is trending to be similar to 2013. ~4000 tonnes per year.

In order to determine if gold is a good investment, one must have a view of the economic environment. Gold is a good investment when traditional assets are unlikely to maintain your purchasing power. That is, they are likely to depreciate when priced in gold, because they are tied to a declining economy. We are in one of these periods today and have been so for the last 12 years.

When growth is strong you will do better in traditional investments. They are exposed to growth and will outperform inflation hedges in such a climate. A classic example of such an environment would be the 1980-2000 period. Are we likely to enter such an environment again in the future? The key is to know when this new cycle has begun.

Warren does not believe in gold because it cannot produce anything, it has no output unlike holding companies and securities that offer yield. However I treat gold mainly as a CRISIS HEDGE and use the extremely long term horizon, holding for 10 years and above. With so much liquidity (money) in the system, there is plenty of fear in markets these days. Fear that paper assets will depreciate, fear that governments would not be able to repay their debts, fear that markets will collapse and etc. One thing I'm sure there will always be a NEXT CRISIS.

How to buy (approved by Bank Negara) gold in Malaysia?

You will need a current or savings account with the bank that is selling gold.

You will need to buy a initial minimum of 20g. At current price have at least RM 3000.

Subsequent buys must be done in bulks of 5g each. E.g. 5g, 10g, 15g and etc.

You should have a minimum of 10g in your gold account to avoid the monthly charges. If you intend to sell almost all just close the account.

UOB bank offers the cheapest gold price that you can purchase in Malaysia.

http://goldaboutinvestment.com/malaysia-banks-gold-price

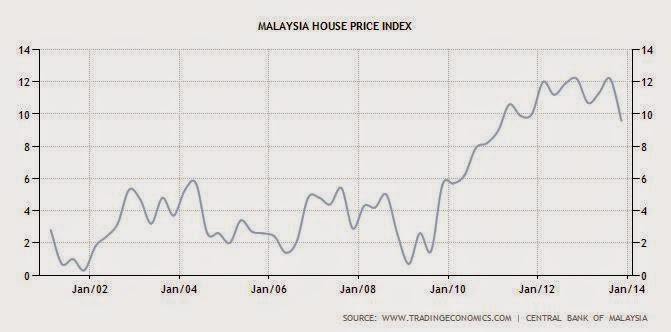

Below is the US house price index. Post-WW2 house prices went up and stayed the same due to one sole thing: Population boom and rising middle class. The same goes to Malaysia back in 1980s to 1999 pre Asian Financial crisis. We have past that era. In fact our total % of working person to population will peak in 2020 according to the world bank.

The America has had 3 housing boom & bust while Malaysia has had 1 before. My point here is everything that goes up above the trend will go down eventual. It applies to stock market, gold, house prices, even my Lego pieces. The difference is in the time frame due to the liquidity of the transaction. Why does it takes years for house prices to correct? Because it is illiquid. In the stock market I only need 3 days to cash out, can you do that for your home? As such you will need to look at a longer horizon. A decade (10 years) is a good measure. Go figure....

No comments:

Post a Comment