It is true that over the last decades since inception, EPF

has done a decently good job at managing our savings fund. EPF declares an

annual dividend on funds collected which hit a record high when Malaysia was an

established manufacturing base and has since been progressively declining since 1996 and will continue to do so. The reason is simple; the lowered dividend

rates are a result of EPF’s decision to invest in low-risk held to maturity

investments, plainly speaking Malaysian

Government Securities, loans, bonds and other money market instruments.

EPF’s exposure in held to maturity

investments is now at a staggering 60% and is expected to gradually increase

due to growing national debt, yes GROWING. The underlying problem with this

strategy is that it is tightly knit with

the interest market rate and for the past few years it has been low and

will continue to do so owing to the slow recovery global economy. Expect an average of 5%.

|

| Source: KWSP's annual reports |

In April 2012, it announced that it

will increase its investment in global equity and fixed income as part of its

diversification strategy which is in line with the mandate given by the

government for the EPF to invest up to 23% of its investment assets in

international markets (currently at 14%). This pressure came about as the fund is

growing at a large pace of nearly RM4 billion a month. It faces constraints

domestically given the limited breath of investment products and liquidity to

trade on large volumes. Hence it is moving to increase its investment overseas

to complement EPF’s long-term investment plan and to provide a “reasonable

rate” of return to the savings of its members.

|

Source: KWSP Annual Report for

Financial Year 2011

|

In a separate report it is said

that the fund’s global portfolio will be 20% by 2014. But remember, by going

overseas, the fund will not be given the same preferential treatment as it has

locally. It may very well be suckered into making deals. Domestically it was

easy for EPF to take over our “daylight robber” PLUS highway with the backing

of the government. Looking offshore, Khazanah paid a ridiculously high premium

for healthcare assets in Singapore just because we have to cross a bridge just

to get here oh??. So how confident can

we be in making better returns overseas?

Nevertheless, EPF’s move is

inevitable as it is becoming too large for the domestic market. EPF owns

roughly 10-15% of the equity stock market and has crowded out other players,

driven up valuations and reduced our already illiquid market. "And during

his speech at Invest Malaysia 2010, Prime Minister Datuk Seri Najib Razak had

said the EPF accounted for up to 50% of the local equity market's daily trading

volume, which is NOT healthy. From an efficient market perspective, the stock

market must be liquid enough such that no one single player can control the

market," he added.

|

Source: Securities Commission Malaysia

and KWSP annual reports

|

Looking overseas is positive for

both the local economy and state investment funds. By extrapolating the growth

of EPF and Bursa Malaysia, EPF will reduce its domestic equity stake to less

than 10% by the year 2020 (assuming 35% in equities with 23% of it being

global). With Bursa having a larger capital base but almost similar growth rate

to that of EPF, more market

capitalization will be available primarily to institutional funds like unit trust funds and secondly to retail

investors (people like aboi who buys and sells as he pleases).

Investing your EPF monies in unit trust products gives you the opportunity to optimize the potential of your EPF savings for potentially higher returns (at acceptable level of risks) over the long-term, thus providing you with a potentially bigger pool of funds upon retirement. The scheme allows EPF members to invest 20% of the amount in excess of the required Basic Savings in Account I.

Investing your EPF monies in unit trust products gives you the opportunity to optimize the potential of your EPF savings for potentially higher returns (at acceptable level of risks) over the long-term, thus providing you with a potentially bigger pool of funds upon retirement. The scheme allows EPF members to invest 20% of the amount in excess of the required Basic Savings in Account I.

You can only invest through appointed unit trust management

companies by the Ministry of Finance. You can find it via http://www.kwsp.gov.my/portal/en/web/kwsp/member/members-savings-investment-withdrawal.

You are allowed to make your second withdrawal three months after your first

withdrawal, provided you are still eligible. Why invest via this scheme?

1. No cash investment required - Investment is transacted directly from your EPF Account 1.

2. Diversification - Opportunity to diversify your retirement funds with EPF approved funds.

3. Capital appreciation - Opportunity to reap capital growth as part of the return on your investment to boost the total lump sum of your EPF savings.

And lastly to maximize the power of compounding - If you are ignorant and you continue to hold

your money in EPF which gives you an average of 5% return, how much will it

grow? Your money will only grow 2x times (double) in 14 years. But what if you

can maximize it to say 10%, your money will double in 7.5 years. 15% it grows 4

times every 10 years. If you eat enough ginseng and bird’s nest, you will

probably have a lot of 10 years in your life! If you are 25 and you live until

75, you have five 10 years. Eat more

ginseng and maybe you have six, seven or eight 10 years more.

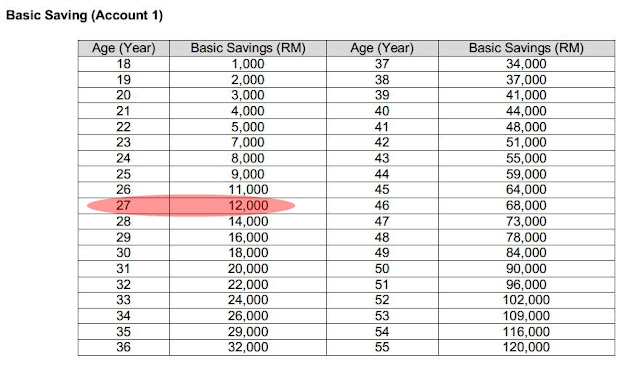

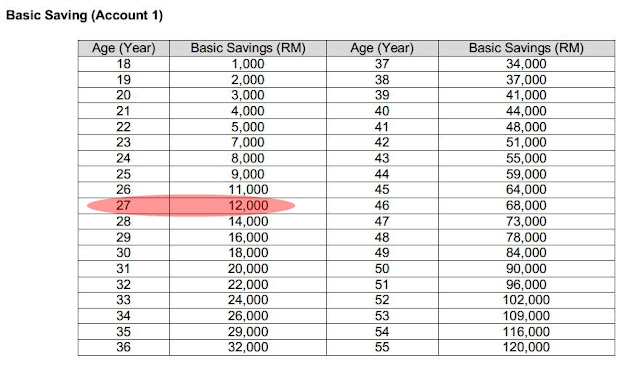

The table above shows the Basic Savings amount required to be

retained in Account 1 based on age. For example: A member at aged 27 with

savings of RM40, 000 in Account 1. The required amount needed is at least RM12,

000. Hence the amount in excess of Basic Savings in Account 1 is as computed:

RM28, 000 (RM40, 000 – RM12, 000). Eligible amount for investment scheme (20% x

RM28, 000) = *RM5, 600. *Please

note that the minimum investment amount for most unit trust funds is RM1, 000.

At 15% returns p.a., RM5, 000 will grow to RM330, 000 in 30 years! But with 5% (EPF) p.a. you will only

obtain RM21, 600. Stretch it to 10% it grows to RM87, 000! Let’s don’t argue at this page whether 15%-10% is achievable

or reasonable, I will leave it for future postings.

Click here for the link to Part 2 of this series.

Click here for the link to Part 2 of this series.

No comments:

Post a Comment